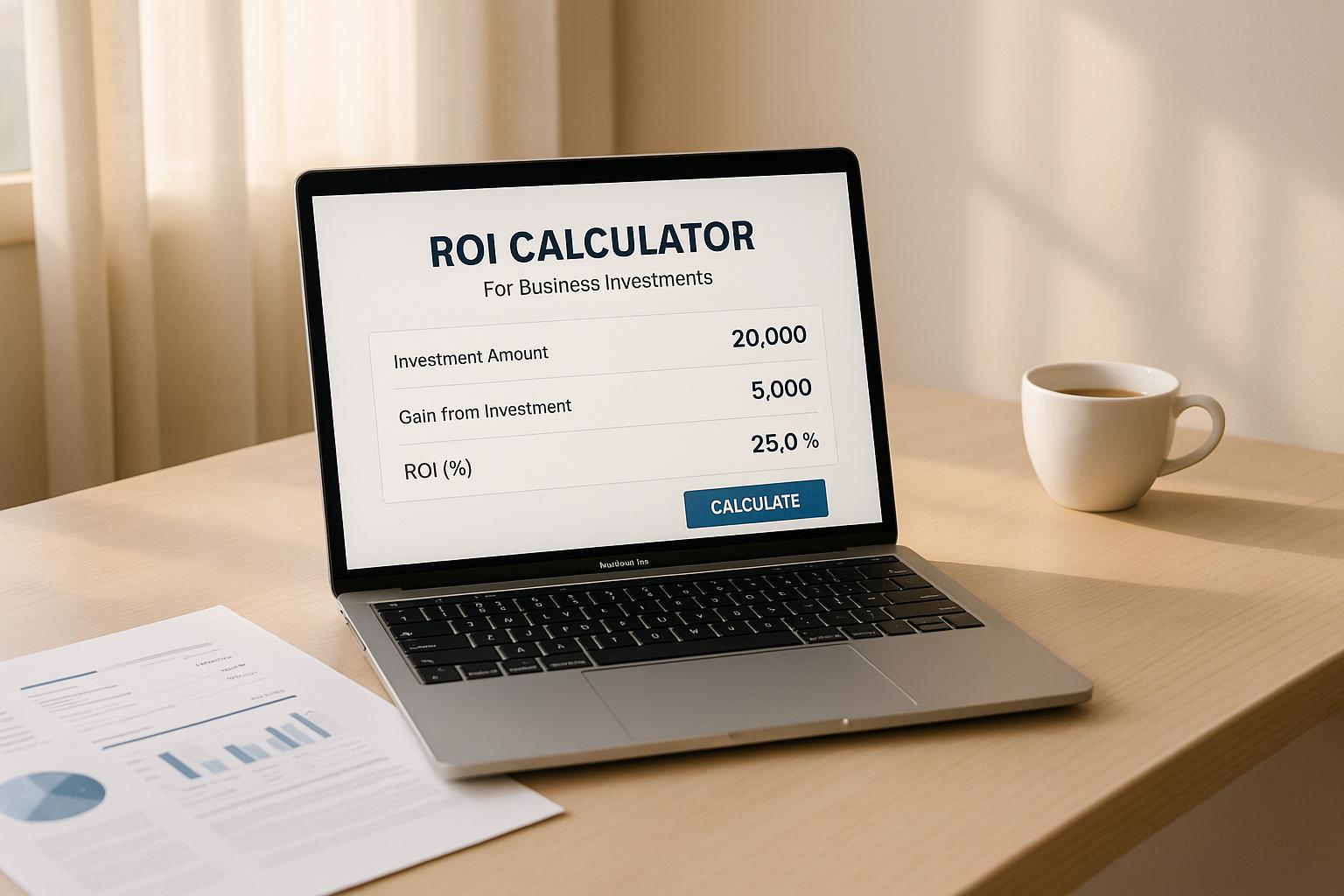

ROI Calculator for Business Investments

Unlock Smarter Decisions with a Business Investment ROI Calculator

When it comes to growing your business, understanding the potential returns on a project is crucial. That’s where a tool to evaluate investment returns comes in handy. It takes the guesswork out of financial planning by breaking down complex numbers into easy-to-read results like profitability percentages and break-even timelines.

Why Calculate Returns Before Investing?

Every business owner knows that not all projects are created equal. Some ventures promise big payouts but come with hefty costs, while others might seem modest yet deliver steady gains. By using a financial analysis tool, you can input key details—think initial costs, expected revenue, and duration—and instantly see if the numbers stack up. This kind of clarity helps you prioritize where to put your money and avoid risky bets.

Beyond the Numbers

More than just a calculator, this resource empowers you to plan with confidence. Whether you’re a startup founder or a seasoned entrepreneur, having data-driven insights at your fingertips can shape smarter strategies. So, next time you’re weighing a big decision, let a profitability estimator guide you toward the best path forward.

FAQs

What exactly does ROI mean for my business?

ROI, or Return on Investment, measures how much profit you’re making relative to what you’ve put in. Think of it as a way to see if your project is paying off. For example, an ROI of 50% means you’re earning $1.50 for every dollar invested. Our tool calculates this by comparing your total revenue against your costs, giving you a clear percentage to work with.

How is the break-even point calculated?

The break-even point tells you how long it’ll take to recover your initial investment based on your yearly profit. We figure this out by dividing your upfront cost by the difference between your annual revenue and operating expenses. If the numbers don’t add up (like if costs exceed revenue), it means breaking even isn’t possible under current conditions, and you’ll see a note about that.

Can I use this tool for multiple projects?

Absolutely! You can run the numbers for as many projects as you’d like. Just refresh the inputs each time to test different scenarios. It’s a great way to compare potential investments side by side and figure out which one offers the best return for your business goals.