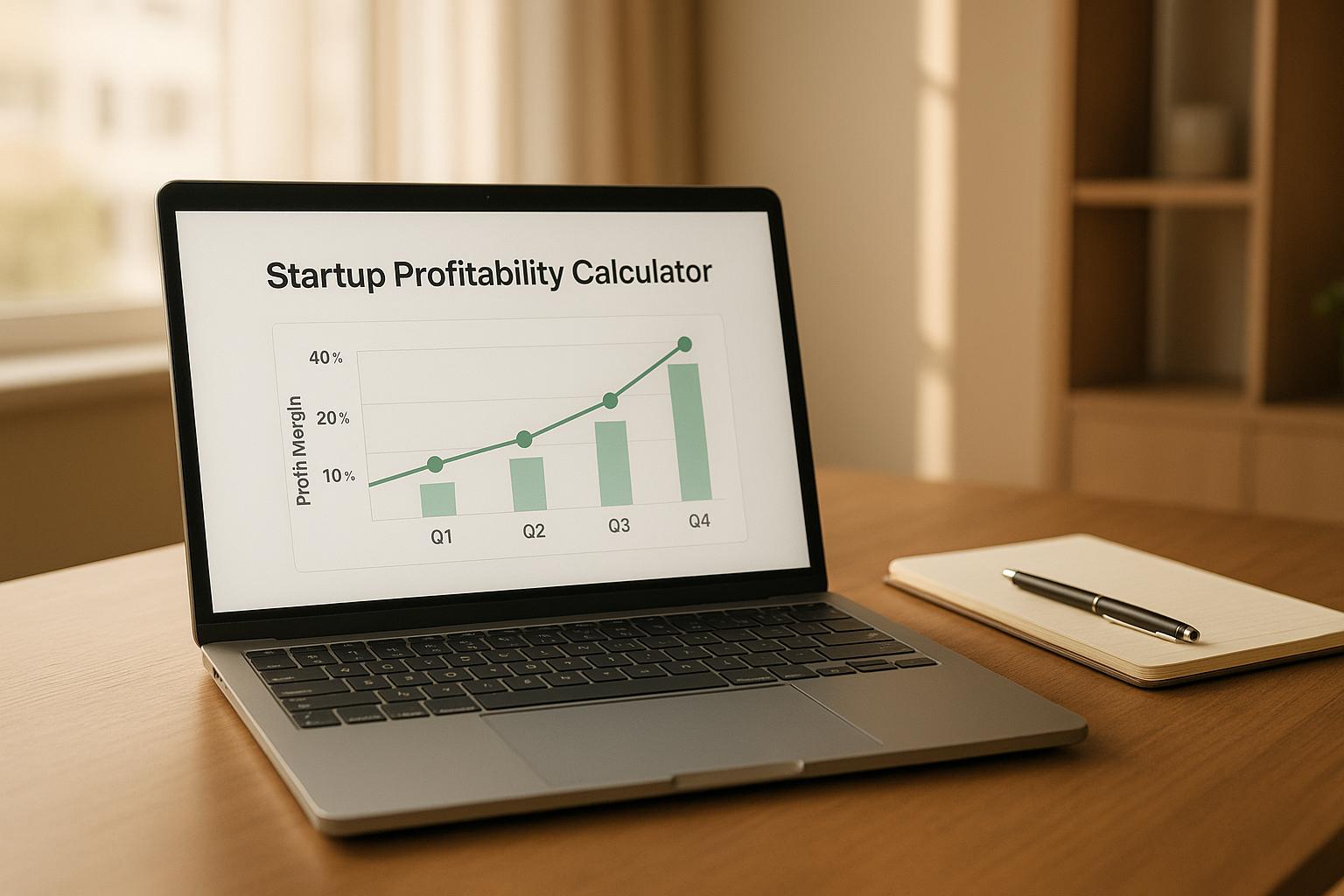

Startup Profitability Calculator

Unlock Your Startup’s Financial Potential with a Profitability Calculator

Starting a business is an exciting journey, but keeping track of finances can feel like a daunting task. That’s where a tool to assess your startup’s financial health comes in handy. Whether you’re just launching or scaling up, understanding your profit margins is key to making informed decisions and ensuring long-term success.

Why Financial Clarity Matters

Every entrepreneur dreams of growth, but without a clear picture of revenue, costs, and profits, it’s easy to veer off course. A business profitability tool simplifies this by breaking down complex numbers into actionable insights. You can quickly see where your money is going—whether it’s high operating costs or unexpected taxes—and adjust your strategy accordingly. This kind of clarity helps you focus on what matters: building a sustainable venture.

Take Control of Your Numbers

Don’t let financial uncertainty hold you back. By regularly checking your gross and net profits, you’re not just crunching numbers; you’re gaining the confidence to pivot when needed. Tools designed for entrepreneurs make this process accessible, even if you’re not a numbers person. So, take a moment to evaluate your startup’s performance and chart a path to growth with ease.

FAQs

What exactly does profitability percentage mean for my startup?

Great question! Profitability percentage is a simple way to see how much of your revenue turns into actual profit after all costs are covered. It’s calculated as (net profit / revenue) x 100. So, if it’s 20%, that means for every dollar you make, 20 cents is profit. A higher percentage generally means your business is in a healthier spot, while a negative number signals a loss—something you’d want to address by looking at expenses or pricing.

What if I enter a negative number or zero for revenue?

No worries, we’ve got that covered. If you input a negative or zero revenue, the tool will display an error message asking you to check your numbers. It’s just a little nudge to make sure you’re entering realistic data. After all, revenue can’t be negative in most cases, and zero might mean there’s nothing to calculate. Double-check your figures, and you’ll be good to go!

How can I improve my startup’s profitability if I’m at a loss?

Seeing a loss can be discouraging, but it’s often fixable with a few tweaks. Start by reviewing your operating expenses—can you cut back on subscriptions or negotiate better rates with suppliers? Also, take a hard look at your cost of goods sold; maybe there’s a cheaper material or vendor out there. Finally, consider if your pricing reflects the value you’re offering. Small increases can make a big difference. Our tool will point out areas to focus on, but don’t hesitate to chat with a financial buddy or mentor for deeper insights.