Business Loan Interest Estimator

Plan Smarter with a Business Loan Interest Estimator

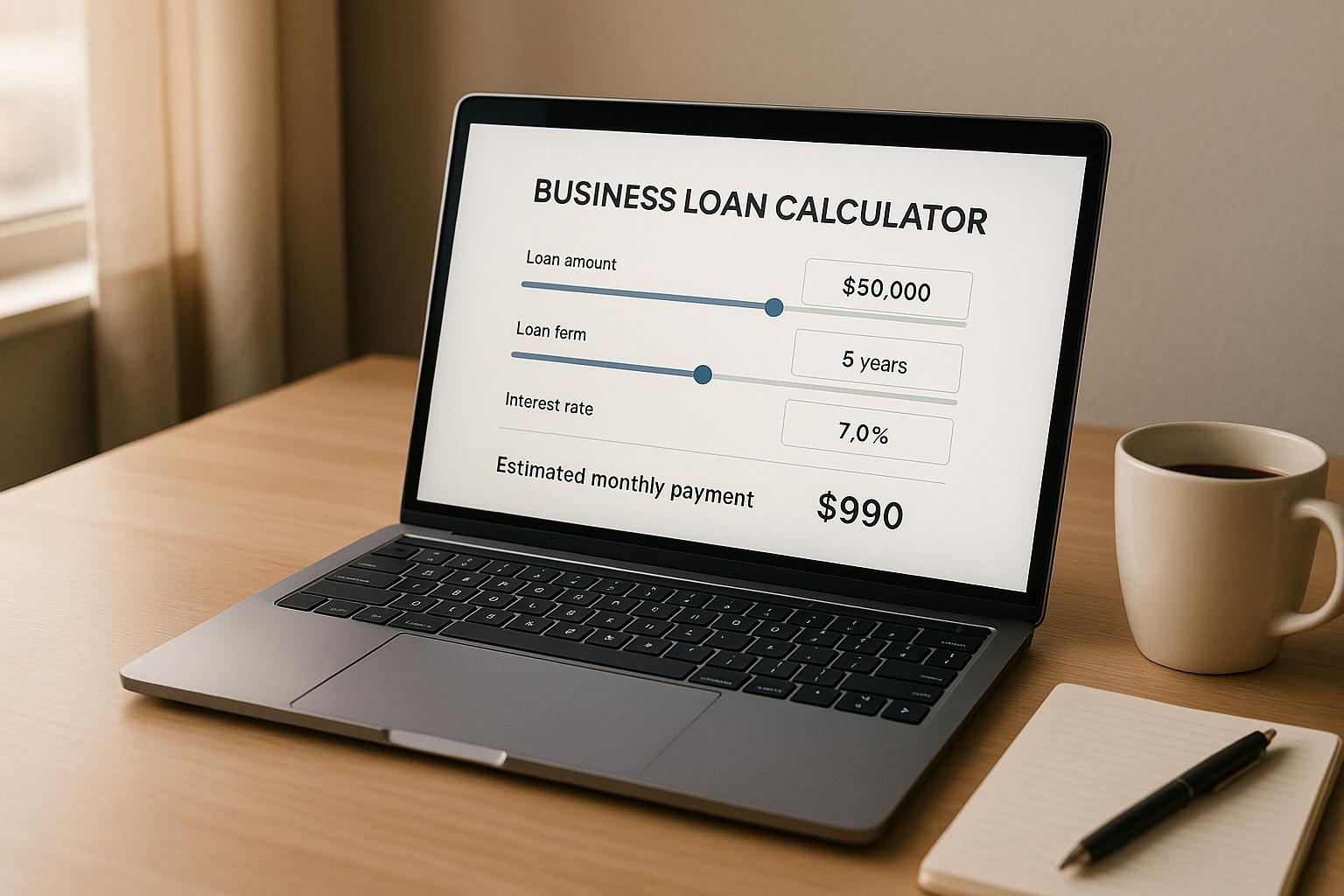

Running a small business often means seeking financing to grow, and understanding the cost of borrowing is crucial. A tool to calculate loan interest can be a game-changer for entrepreneurs who want clarity before signing on the dotted line. By entering basic details like the amount borrowed, rate, and repayment timeline, you can uncover the total expense of a loan and see how it fits into your budget.

Why Estimate Loan Costs?

Borrowing for your business isn’t just about getting funds—it’s about knowing what you’ll owe down the road. Hidden costs like accumulated interest can sneak up if you’re not prepared. Using a calculator for financing costs helps you visualize monthly obligations and the overall burden, so there are no surprises. Plus, it lets you compare different offers from lenders to find the most affordable option. Whether you’re expanding operations or covering short-term needs, having a clear picture of repayment terms empowers better decisions. Take a moment to crunch the numbers; it’s a small step that could save you thousands over the life of your loan.

FAQs

How accurate is this business loan interest estimator?

Our tool uses standard amortization formulas to calculate interest and repayments based on the data you provide. It assumes a fixed interest rate, so if your loan has a variable rate or includes extra fees, the actual costs might differ. Think of this as a solid starting point to understand potential expenses, but always double-check with your lender for the final numbers.

Can I use this tool for different types of business loans?

Absolutely! Whether it’s a term loan, equipment financing, or a line of credit with a fixed rate, this estimator works for most scenarios. Just input the loan amount, rate, and term as they apply. If your loan structure is more complex—like interest-only periods or balloon payments— the results might not fully match, so reach out to your financial advisor for tailored advice.

Why does the repayment schedule matter?

Seeing the repayment schedule helps you understand how much of each payment goes toward interest versus the principal over time. Early on, you’ll notice interest takes up a bigger chunk, but as you pay down the loan, more of your money reduces the actual debt. This breakdown can help with budgeting and deciding if paying extra early on could save you on interest costs.